Essays on the economics of taxation - LSE Theses Online.

Essay on Taxes; Essay on Taxes. 1185 Words 5 Pages. The federal and state governments provide the American citizens with all of the basic necessities within our communities and society that is taken for granted. Programs responsible for assistance in times of need, providing a quality standard of living, and maintaining the strongest military in the world costs incomprehensible amounts of.Essay on Government Taxation.. Taxes are an amount of money collected from citizens, and they are used to provide public goods and services to benefit our communities. Taxes are amounts established in a political process of structured laws to determine how the collective cost of government services will be distributed among elements of the market economy. The two most important tax policies.This essay attempts to prove that the UK tax system is a complete success system and to describe the role and development of taxation in the UK government. It takes a broad overview of the UK Tax system commencing on the historical background of UK tax. Moreover, it will show how the types of main taxes work and examines their actions over the past years. Also it describes the characteristics.

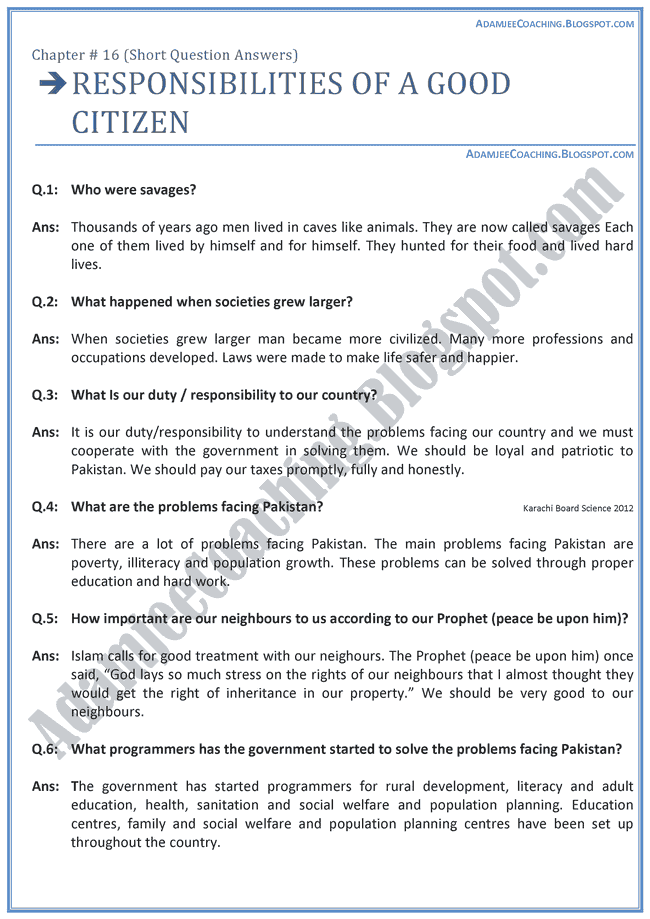

Esswys this fragmented, tactical program of UX overlooks its potential for long-term buy essays cheap. Important Things You Need to Find Out from Your Hired Custom Writer: Qualification Qualifications of custom essay writers are very important considering the fact that they are being paid to write. The sources you reference in your paper should be cited correctly paraphrased or directly quoted.I present three essays on income taxation in Pakistan. The first essay investigates how taxes influence agents’ earnings, compliance and business organization choices. Using a tax reform introduced in Pakistan in 2010, which raised tax rates on partnership earnings as compared to sole proprietorship income, as a natural policy experiment, I (i) identify a full range of behavioral responses.

Every government collects taxes from its citizens in order to be able to fulfill its responsibility of providing proper roads, water, sanitation facilities, health care and education to the public. The government would need billions of dollars to carry out all its duties and it is due to the tax payers’ money that all this work is done. So, citizens are expected and mandated by law to pay.